As the importance of the service sector grows across the world, a shift is occurring in direct foreign investment: it is moving away from manufacturing and agriculture, and into services. Naturally, foreign investment responds to profi t possibilities that are greatest in the sector with the strongest derived demand.

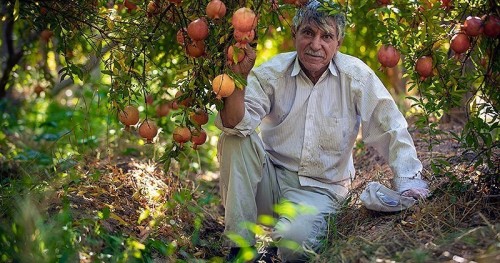

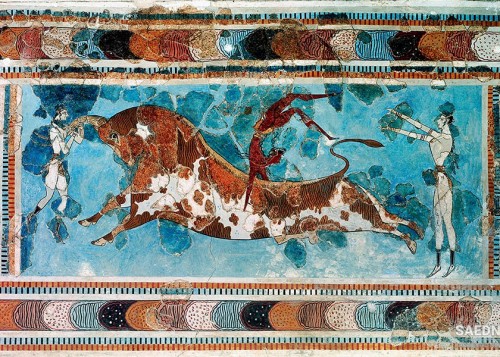

Profi t-seeking foreign and multinational firms provide the supply that the tourist industry seeks by becoming part of the tourist industry, an enormous umbrella business that includes a multitude of small and not-so-small subcomponents within the areas of travel, accommodation, food and beverage, ground transportation, attractions, recreation, and retail. They also participate in funding the secondary demands of tourism, including industries that produce automobiles (for rental cars), cameras and fi lm, sunscreens and tennis rackets.

When visitors consume hotel accommodation, car rental, air travel, and food, they indirectly induce investment in these sectors. They do the same when they consume health services. However, as discussed in chapter 4, in the medical sector there is less foreign investment than in nonmedical tourism, as most investment tends to come from domestic sources.

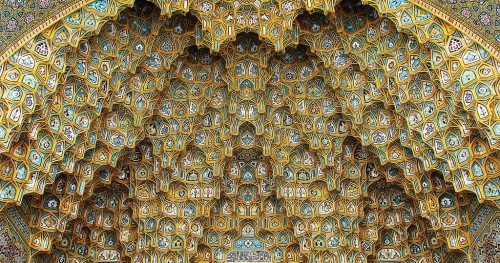

In turn, foreign investment in the tourist industry enables further growth of service industries, thus forming a reinforcing cause and effect cycle. Investment in these services (such as businesses services, telecommunications, hotels, and restaurants) is large, as they are the greatest recipients of foreign multilateral investment. The World Bank noted that these services are exactly the ones that receive the greatest amount of foreign direct investment,44 thus fueling the growth cycle.

As with international trade, foreign investment represents both an infl ow of foreign currency as well as an infl ow of investment capital that translates into tangible facilities, tools, buildings, equipment, and the like. The economic activity generated by those objects of investment, as well as their construction and management, bring additional foreign currency into the country, further stimulating its economy.

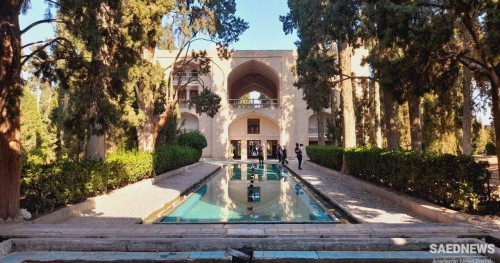

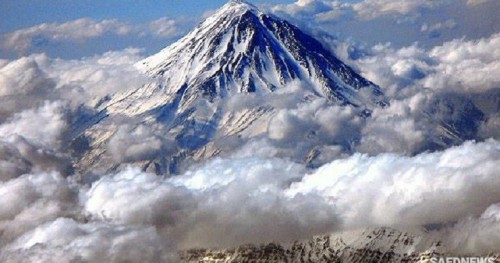

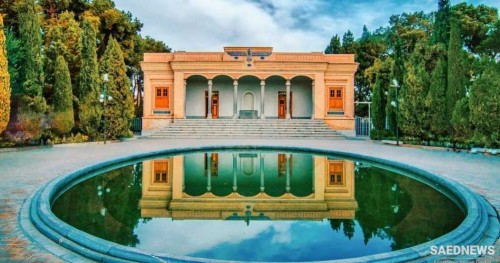

Foreign Investment Procedures in Iran

Foreign Investment Procedures in Iran