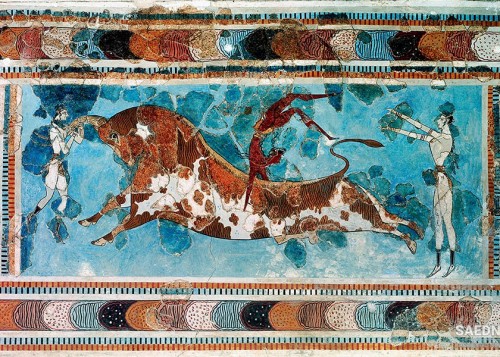

The other main objective referred to in the UN General Assembly’s resolution concerning the establishment of a world food reserve was that of counteracting excessive price fluctuations. This was described in the FAO report as ‘a large subject and a very important one’. It therefore felt that it might come as a surprise that ‘in sharp contrast’ to the number of proposals that had been put forward for the operation of international commodity stabilization reserves, or buffer stocks, ‘the history of the world since the days of Joseph yields no peacetime examples of any such reserves ever having been operated on an international scale for any foodstuffs, or group of foodstuffs’. (A relatively small tin buffer stock managed by producers operated in the 1930s was the only international buffer stock ever established for any primary product.) Therefore, as there was no previous experience to draw on, the report turned to the nature and causes of price fluctuations for agricultural products. Short-term movements in the prices of primary products, and particularly agricultural commodities, if left entirely to the free play of market forces, ‘tend to be excessive and harmful to the long-term interests of both producers and consumers’. The fundamental reason for this was that ‘owing to the low short-term elasticities of demand and supply, even small changes in the balance of production and consumption tend to be associated with large variations in prices’. Short-term price movements may be the cause of a fresh disturbance of the balance of production and consumption in a later period ‘owing to the slowness of production responses to price changes’. In markets where wide price fluctuations were common, the behaviour of stocks ‘may tend to exaggerate the instability of prices even further, owing to the perverse influence of speculative stock movements’ (FAO, 1952b). Smoothing excessive short-term price fluctuations was not only in the interest of both producers and consumers but also in the wider interest of world economic stability generally. Price instability had a major adverse impact on developing countries whose economies depended in large measure on receipts from the export sales of one or a few primary products. It could also have adverse effects on the economies of importing countries and may cause disturbingly large variations in the balance of payments, and on the living standards of consumers everywhere. Concerning what constituted ‘excessive’ price instability, the FAO report quoted from the report of a group of UN experts (UN, 1953). ‘Excessive’ referred to both the frequency and amplitude of price fluctuations. The encouragement of a better allocation of economic resources, which was the desirable result of price changes, should be achieved without violent instability. If prices had to change by 15 per cent or 20 per cent from year to year in order to achieve minor allocations in resource allocation, this would raise serious doubt about the effectiveness of this method of securing a desirable allocation.

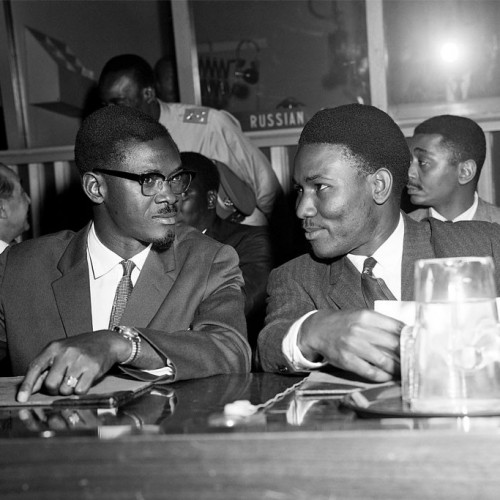

World Food Security Concerns and Formation of Global Organizations

World Food Security Concerns and Formation of Global Organizations