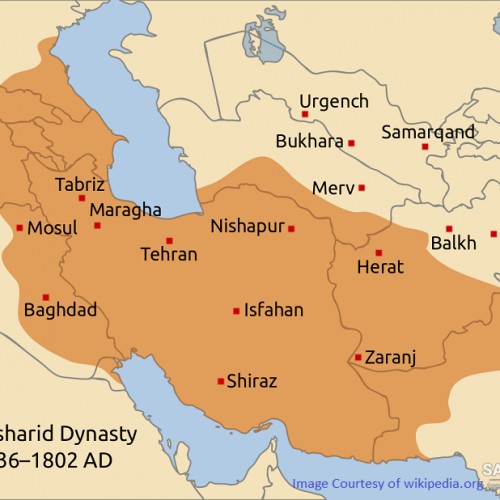

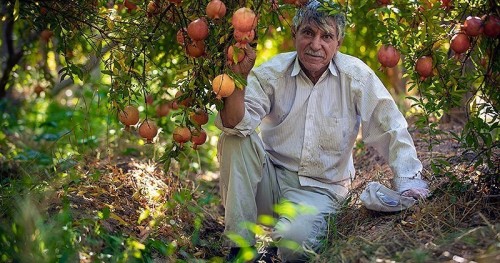

The nearly bankrupt Iranian treasury secured a loan of £2,400,000 ($12,000,000) from the Russian Mortgage Bank of Persia to pay off previous British loans, but at the heavy price of farming out nearly all the remaining Iranian customs revenue. A team of Belgian officials who initially had been employed to supervise the administration of Iranian customs gravitated toward the Russian authorities. Although they introduced new regulations, revised practices, and increased state revenue through the imposition of stricter tariffs, they were more loyal to the Russian creditors than to the Iranian government. The Iranian merchant community was already resentful of the ad valorum tax imposed on Iranians at a higher rate than the tariffs for European trading houses, a disadvantage rooted in the Torkamanchay commercial treaty. The doubling of customs duties under the Belgian administration only generated further discontent, but higher customs duties were only part of the problem. The greater part was a shift in trade patterns. In the last quarter of the nineteenth century, Iran’s foreign imports, mostly commodities such as tea and sugar as well as manufactured goods including cotton and woolen fabrics, increased substantially. By 1900 Iran’s population had reached ten million—twice the size of the population a century earlier—and nearly 25 percent lived in cities. In the first decade of the twentieth century cotton fabrics, sugar, and tea constituted 61 percent of Iran’s total imports. Sugar from Russia, France, and Austria amounted to 26 percent of all imports, with a value of $6,250,000. In the mid-1890s Iran’s estimated volume of foreign trade stood at $25 million, while total state revenue for the same period was no more than $12,500,000. The increase in the volume of imports was in contrast to a steady drop in the value of exports. Compared to the middle of the nineteenth century, by 1910 the value of Iran’s three traditional export commodities—silk, opium, and cotton fabrics—had dropped in proportion to total trade by a massive 74 percent. The exports of raw cotton and carpets, however, had increased in value, but only by 26 percent. By 1910 Iran exported about $20 million and imported $25 million annually, causing a cumulative 20 percent deficit in the balance of its foreign trade. This imbalance contributed to a steady fall in the value of Iranian currency. Between 1875 and 1900 the tuman depreciated 100 percent against the British pound, which triggered a rise in the price of imported goods in the domestic market and more vulnerability to international fluctuations.

Economic Downturn and Dismissal of Amin al-Dowleh

Economic Downturn and Dismissal of Amin al-Dowleh