Travel insurance is a type of insurance that covers the costs and losses associated with traveling. It is useful protection for those traveling domestically or abroad. According to a 2020 NerdWallet survey of 2,000 Americans, only one in five Americans bought travel insurance for leisure trips prior to COVID-19. But 45% say they're likely to purchase travel insurance for future leisure trips.

Many companies selling travel packages also offer travel insurance. Some travel policies cover damage to personal property, rented equipment, such as rental cars, and even ransom requests.

The main categories of travel insurance include trip cancellation or interruption coverage, baggage and personal effects coverage, medical coverage, and accidental death or flight accident coverage.

Coverage often includes 24/7 emergency services, such as replacing lost passports, cash wire assistance, and re-booking canceled flights.

Many companies selling tickets or travel packages, give consumers the option to purchase travel insurance, also known as travelers insurance. Some travel policies cover damage to personal property, rented equipment, such as rental cars, or even the cost of paying a ransom. Frequently sold as a package, travel insurance may include several types of coverage. The main categories of travel insurance include trip cancellation or interruption coverage, baggage and personal effects coverage, medical expense coverage, and accidental death or flight accident coverage.

Coverage often includes 24/7 emergency services, such as replacing lost passports, cash wire assistance, and re-booking canceled flights. Also, some travel insurance policies may duplicate existing coverage from other providers or offer protection for costs that are refundable by other means.

ravel insurance will vary by the provider on cost, exclusions, and coverage. The buyer should be aware of reading all disclosure statements before they purchase the insurance. Coverage is available for single, multiple, and yearly travel. Per-trip coverage protects a single trip and is ideal for people who travel occasionally. Multi-trip coverage protects numerous trips occurring in one year, but none of the excursions can exceed 30 days. Annual coverage is for frequent travelers. It protects for a full year.

In addition to the duration of travelers insurance coverage, premiums are based on the type of coverage provided, a traveler's age, the destination, and the cost of your trip. Standard per-trip policies cost between 5% to 7% of the trip’s cost. Specialized policy riders focus on the needs of business travelers, athletes, and expatriates.

Also, when traveling, it is suggested that a traveler register travel plans with the State Department through its free travel registration website. The nearest embassy or consulate can contact them if there is a family, state or national emergency.

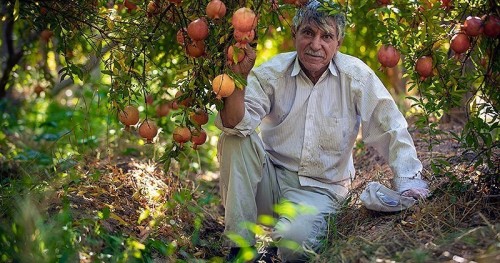

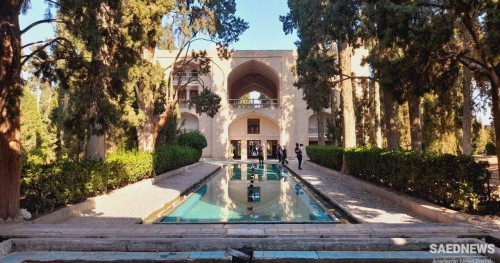

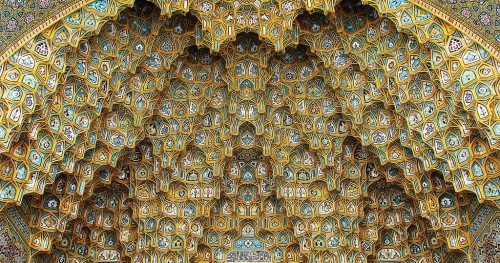

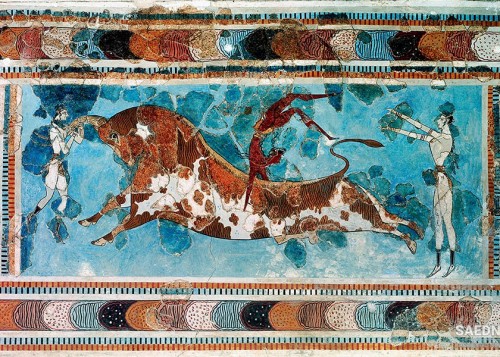

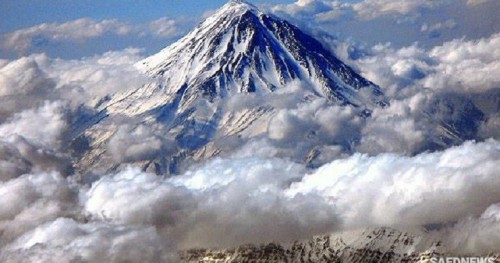

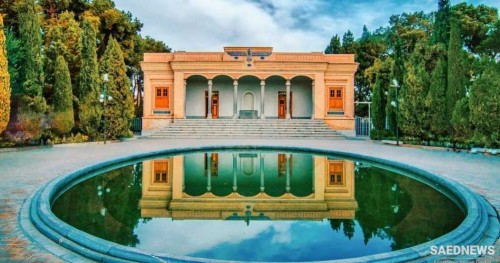

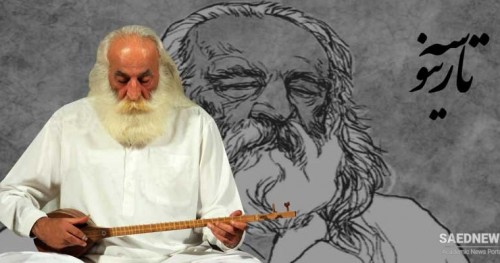

Tourists and Health Care Problems in Iran: A to Z of Medical Service in Persia

Tourists and Health Care Problems in Iran: A to Z of Medical Service in Persia